(D.B.A. TRABAJANDO PARA TI, LLC)

Income Tax Consultation

We will assist you by answering any questions you have regarding your personal income TAX returns.

TO QUALIFY FOR THIS PROMOTION YOU MUST DECLARE INCOME ONLY FROM W2S

Limited Time Offer-Income Tax Preparation For Only $75

FREE Income Tax Filing!

We will file your taxes for FREE if you refer (3) three new clients that have their taxes filed by us.

Preparation with Income Source from: 1099-MISC Forms, Sub-Contractor, Personal Checks or Cash & TAX ID (ITIN) APPLICATION PACKAGE

Personal Checks or Cash

If you receive income through CASH, personal checks, 1099-MISC Form, or you are a Subcontractors or Self-Employed the extensiveness and the complexity of your income tax preparation is high. The preparation fees start at: $199 USD To receive a fair price quote schedule consultation today.

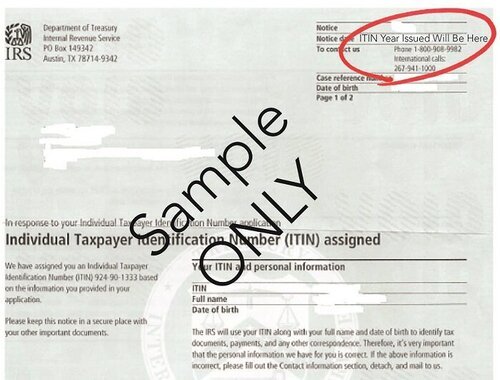

TAX ID (ITIN) APPLICATION PACKAGE

To obtain a Tax ID number is a two step process. We will assist you with both. 1.) Applying for a Tax ID number (also known as the Individual Tax Identification Number - ITIN). 2.) Prepare your Income Tax Return that needs to go alongside your ITIN application. Fee for this service package is $250 USD

NOTICE: The IRS has mandated that any individual applying for a Tax ID (ITIN) Number must file an Income Tax Return with their ITIN application.

Audit Assistance

We will assist you with your AUDIT with the IRS. The work to resolve an Audit is extensiveness and complex. The fee starts at: $199 USD To receive a fair price quote schedule a consultation today!

IRS Correspondence Assistance

We will assist you by explaining the reasons why you are receiving letters from the IRS. And we will provide you with the help to resolve any tax matter. Schedule a consultation today.

LIMITED TIME OFFER: Tax Preparation (TAXES) for ONLY $75!

Frequently

Asked Questions

- You need to submit to the IRS W7 Form, and

- Attach a prepared income tax return

The IRS mandates that you declare ALL earned income

The IRS mandates that regardless of your immigration status you are required to declare and file income tax returns for ALL earned income annually

Yes. The IRS awards Tax ID numbers to any person who has earned income in the United States.

The IRS grants refundable credit to those who can prove that they had college related expenses (i.e. tuition, textbooks, etc.)

The IRS grants credit to those who can prove they are paying interest on a student loan(s)

If you and your spouse are married and you two lived together during the year you are preparing your taxes for, the answer is, NO you cannot declare as Head of Household. Your spouse needs to get a Tax ID number so that you and him/she can declare as Married-Filing-Jointly.

No. The IRS mandates that if you two are married then you have to file together as Married-Filing-Jointly.

Yes and Yes. If you are still supporting your son more than 50% then you can claim him as a dependent. And yes, he can also file his own taxes. But only one of you is allowed to claim him as an exemption on your taxes.

No. The IRS does not permit you to claim your spouse as a dependent unless they are permanently disabled. If they are not permanently disabled they must be declared as your spouse.